Tax Rate of Company. Tax Rate Table 2018 Malaysia.

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Basic supporting equipment for disabled self spouse child or parent.

. Whats people lookup in this blog. The amount of tax relief 2018 is determined according to governments graduated scale. Malaysia Personal Income Tax Rate.

Malaysian Income Tax Rate 2018 Table. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Malaysian Income Tax Rate 2018 Table masuzi December 13 2018 Uncategorized Leave a comment 3 Views Personal tax archives updates what is tax rate in malaysia malaysian tax issues for expats individual income tax in malaysia for.

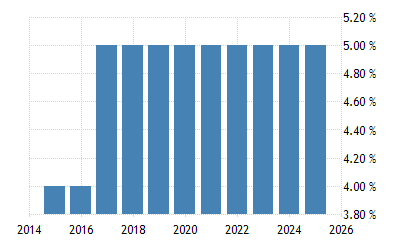

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with. Personal Income Tax Rate in Malaysia averaged 2729 percent from 2004 until 2020 reaching an all time high of 30 percent in 2020 and a record low of 25 percent in 2015. Tax Rate of Company.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. Company Taxpayer Responsibilities. 20182019 Malaysian Tax Booklet 23 An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect.

Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the purpose to reduced the burden of tax payers. On the First 5000 Next 15000. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020.

Malaysia personal income tax guide 2019 ya 2018 money malay mail the gobear complete guide to lhdn income tax reliefs malaysia malaysia personal income tax rates table 2017 updates taxplanning budget 2018 wish list the edge markets. Income tax how to calculate bonus and personal tax archives updates malaysian tax issues for expats audit tax accountancy in johor bahru. 24 Year Assessment 2016.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022. Tax Rate Table 2018 Malaysia.

Income tax how to calculate bonus and free malaysia today malaysia personal income tax guide 2019 ya 2018 money malay mail malaysia personal income tax rates table 2017 updates 85 info tax exemptions malaysia 2019. Company with paid up capital not. Income Tax Rate Table 2018 Malaysia.

Tax Rate Tables 2018 Malaysia masuzi December 11 2018 Uncategorized Leave a comment 4 Views Corporate tax rate 2018 audit tax accountancy in johor bahru malaysia personal income tax guide 2019 comparing tax rates across asean. The Tax tables below include the tax rates thresholds and allowances included in the Malaysia Tax Calculator 2019. Income Tax Rates and Thresholds Annual Tax Rate.

Tax Rates for Basis Year 2018. Masuzi December 14 2018 Uncategorized Leave a comment 0 Views. Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region.

20182019 Malaysian Tax Booklet Personal Income Tax. Malaysia Residents Income Tax Tables in 2019. Income Tax Rate Table 2018 Malaysia.

Commissioner for Revenue Inland Revenue Personal Tax Tax Rates 2018. Income attributable to a Labuan business. Company with paid up capital more than RM25 million.

20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Income Tax How To Calculate Bonus And Free Malaysia Today Fmt Personal Tax Archives Updates Budget. Year Assessment 2017 - 2018.

The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. TAX RATES Chargeable Income. Whats people lookup in this blog.

13 rows Personal income tax rates. Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Malaysian Income Tax Rate 2018.

Company with paid up capital not more than RM25 million.

Income Tax Malaysia 2018 Mypf My

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

How Train Affects Tax Computation When Processing Payroll Philippines

Effective Annual Rate Formula Cocoacxv

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

How To Calculate Foreigner S Income Tax In China China Admissions

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Eritrea Sales Tax Rate Vat 2022 Data 2023 Forecast 2014 2021 Historical

2018 2019 Malaysian Tax Booklet

Income Tax Malaysia 2018 Mypf My

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Individual Income Tax In Malaysia For Expatriates

Income Tax Malaysia 2018 Mypf My

United Arab Emirates Corporate Tax Rate 2022 Data 2023 Forecast

China Annual One Off Bonus What Is The Income Tax Policy Change

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018